Welcome back to TechCrunch’s continuing coverage of Y Combinator’s Summer 2021 Demo Day! This is Day Two. If you haven’t caught up yet on what happened during the first day, you can read our recap of all the presenting companies here, our favorites from that first set here, and a quick podcast about all of the above.

Today we’re back in the action, listening to a few hundred rapid-fire pitches throughout the day. What follows are short overviews of each company based on their one-minute pitch. Elsewhere on the site we’ll soon have our Day Two favorites for you to enjoy, so be on the lookout for that!

Day Two companies

Intellect: A mental healthcare service that provides teletherapy for employers in Asia. They’ve also got a free consumer app at the top of the funnel that has seen 2.5 million users since launching a year ago. The company says it’s grown to $500,000 ARR in the last six months.

MazumaGo: Banking and electronics payment service for construction companies. MazumaGo aims to help this antiquated industry move off of traditional banking and into a unified ledger. The banking infrastructure product puts credit and debit cards into customer hands, starting in the United States.

Pandai: Pandai is helping kids in elementary/high school in Southeast Asia boost their grades with a learning app that replaces take-home workbooks. With more than 1,600 paying subscribers using the app for almost an hour a day, Pandai may be on its way to helping thousands more get the A.

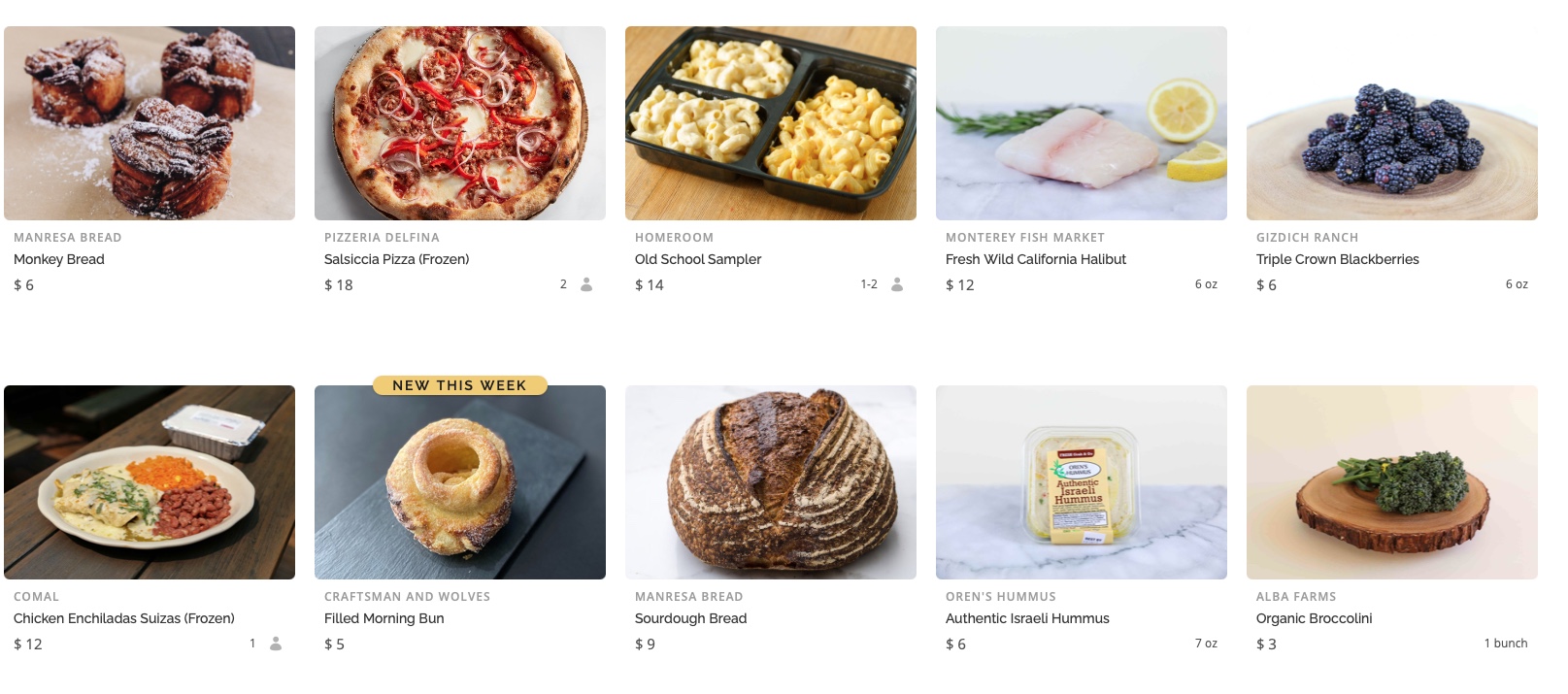

Image Credits: Locale

Locale: Think that DoorDash doesn’t have enough food options? Locale is betting that some folks want more options and are willing to pay for that access. The startup wants to help restaurants sell farther from their operations, and its model is showing some early traction. The company’s revenue (GMV, perhaps) scaled from $145,500 in July to $192,000 in August. The startup claims 70% retention month to month and an average order of just over $100.

Arrow: Arrow is building one-click-checkout-payment infrastructure for online sellers in Southeast Asia aiming to boost social commerce among small sellers. The team behind Arrow helped launch GrabPay and has already scaled GMV at the startup to $150,000.

Talentdrop: A hiring marketplace where open jobs are posted with “bounties.” If someone you refer is ultimately hired and stays a while, you get the bounty. The company says that $1 million in bounties have been posted to the site thus far.

Infina: A retail investing app aiming to be the Robinhood of Vietnam. Since launch in January, Infina has reached over $2.5 million in assets under management. Its first focus was breaking open mutual funds and fixed-income products, and now it wants to head into stocks and crypto for its younger user base.

BlackOakTV: Black millennials are bigger consumers of streaming content than other demographics, but comparatively little of that content is made with them in mind. Black Oak TV is a subscription streaming service by and for Black creators and stars — could the next Dave Chappelle or Issa Rae come from here instead of YouTube or TikTok?

HEO Robotics: This startup wants to leverage unused time on existing satellites that monitor the planet to find stuff in space. Not trash, like the startup that presented yesterday that wants to clean up space around Earth, but things like other satellites. HEO says that it is selling to the Australian government, and executed a live in-orbit demo during Y Combinator. There are going to be many more satellites in space over time, the company says, which could boost demand for its service.

Gallery : Gallery is building a platform to help developers quickly create self-stage staging environments, saving time and energy. The founding team has experience from Facebook and Goldman Sachs and hopes to tackle what it believes is a $5 billion market for mid-sized engineering teams alone.

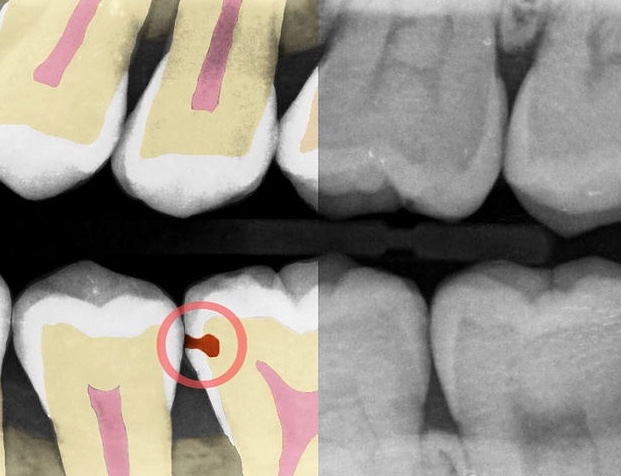

Image Credits: Adra

Adra: AI to help dentists find cavities they might otherwise miss. It can also convert fuzzy X-rays into something a bit easier for patients to understand. Currently in a pilot with 20 dentists.

Tantl: Low-code APIs are hot, and a team of Google and Apple engineers are building Tantl to make it speedy, too. Tantl enables developers to build faster internal workflows — for $20 bucks a seat. Think skipping repetitive code, easy authentication and customer user interfaces. The SaaS business launched last week and has onboarded three customers.

Titipku: A huge amount of people in Indonesia want to do their local shopping online like so many of us already do, and Titipku is ready to make it happen. They’re “Instacart for Indonesia” and that’s that. Sales are already popping and the model is proven, so let’s just offer a preemptive congratulations on their success.

Flok: Flok is building what it describes as an Airbnb for corporate offsites. That means the startup is helping connect companies looking to host some IRL activities with a location that will be suitable. In a remote-first area, heading into a remote-friendly future, companies may spend more time and money bringing staff together sporadically. Flok wants to help those events come together. Per the startup, it takes around 15% of bookings and has booked 45 events so far worth around $200,000 in revenue.

Spark Studio: The team at Spark Studio is building a hub for online extracurricular courses designed for kids, reflecting the COVID-era changes to how kids learn on the web. The team is particularly focused on music, art and communication skills, hoping to streamline the wide offerings of the internet into a platform where high-quality, vetted content lives.

BrightReps: A no-code tool meant to help you shift your company’s customer response workflows from flowcharts/spreadsheets into something more easily updated and iterated upon. Founder Brittani Dunlap says the company is profitable with $740,000 in ARR.

Verihubs: Indonesia has a thriving fintech sector, with hundreds of startups and the well-known unicorn Gojek. Verihubs is launching a data and verification platform for regional fintechs to do stuff like authenticate customer identities and access financial data. The service has landed 45 customers, fueling $41,000 in monthly revenue.

Aleph: A lot of banks and fintech companies want to use the latest financial models but also prefer to rely on the good old spreadsheet. Aleph allows ordinary spreadsheets in Excel or Google Sheets to have specialized financial tools built right in and always up to date. The best of both worlds, if you really love spreadsheets and financial models!

Sirka: Noom is now so big that startups are looking to take its model to new markets. Sirka is one such company, with a focus on the Southeast Asian region. The startup wants to replicate Noom’s science-first approach to weight control, noting that there are 150 million overweight or obese folks in the SEA area. The startup also noted that its users lose 4% of their weight on average. Is that a lot? For me (Alex) at around 160 pounds, that would be around 6.4 pounds.

Watu: Watu wants to help retailers close the sale they almost made. The platform is building a shopping workflow that lives inside emails and allows shoppers to make a purchase without getting tossed back to the mobile web.

Stownest: On-demand, full-service storage spaces for India. They pack up your stuff, store it and bring it back when you need it. The company says it’s helped over 12,000 customers so far, handling over 20,000 pickups/deliveries.

Comet Health: A digital physical therapy platform that combines telehealth with video-based curriculum. Comet Health is launching with a focus on pelvic floor physical therapy and already ran a proof-of-concept pilot in Virginia.

Lemonade Finance: Africa’s banking system is evolving quickly, as we’ve seen from other startups in this batch. Lemonade Finance is a consequence of that — a bank for the millions of Africans who have left for other shores but still need to interact with accounts or people at home, send or receive money and so on. Having encountered this problem themselves, the founders built Lemonade Finance to make it simpler for the African Diaspora to bank abroad.

Parallel Bio: Coming up with ideas for new pharma products, testing them on non-humans and later scaling up to testing on our species takes a long time and is expensive. Parallel Bio claims to have created a human immune system in a petri dish, which can help with testing new drugs sans using humans on the front lines of testing. As with all biotech concerns, I (Alex) struggle to vet the company’s possibilities of a tech breakthrough, but the concept here is very neat.

Atmana: The team at Atmana is building a platform to help 15-30-year-olds break technology addictions, specifically addictions to gaming, porn and social media. The company is taking a serious approach with its $90 per year treatment plans, which combine support groups, accountability and education.

Float: Supply chain finance — in other words, they pay for your inventory upfront, you pay them back as it sells. Float co-founder Rob LaFave previously co-founded/sold Foodzie, while co-founder Zack Kim was the CTO of Zaarly. Float says they’ve deployed $50,000 in advances to five customers so far.

Kitchenful: Led by a former Hellofresh executive, Kitchenful thinks that grocery delivery’s commidification means it’s time for new innovation. The app gives users personalized recommendations for recipes — and then delivers the ingredients straight from a local grocery store. The team has landed partnerships with Walmart, Kroger, Target and REWE for logistics, and has launched in one city so far.

Image Credits: TransAstra

TransAstra Corporation: Space tugs are a hot item in space: small spacecraft that help get other spacecraft where they need to go. TransAstra, from a former Momentus CEO, is using a new, super efficient “solar thermal rocket engine” that he says accomplishes this type of mission better than anything out there. With millions in NASA money and hundreds of millions in LOIs, MOUs and contracts, TransAstra sounds like it’s well on its way to being the biggest name in space tugs.

Comadre: Nubank won’t control the entire Brazilian neobanking market if Comadre gets its way. The company is building a new digital bank for low-income families, a group of folks that it says have to pool their funds together to pay bills on time, so they need new tech. The startup intends to charge $8 per family per month, in addition to generating interchange incomes. Of course, fintech is a competitive market, but if Comadre can land a customer base, its revenue story writes itself.

Toku: The startup helps subscription companies collect revenues in Latin America where 15% of recurring charges fail. While traditional options rely on collection agencies, Toku taps cross-channel outreach to connect with subscribers and get them back in the fold.

Makani Science: This team has built what it says is the “world’s first wireless patch that can accurately and continuously monitor breathing.” Co-founder Michael Chu says the company expects to get FDA clearance within a year.

Verde: Small and medium-sized farms in Brazil may now have a new favorite credit card. Verde is a fintech platform that wants to make it easier for farmers to request and access loans. Beyond credit cards, Verde’s services include insurance and digital banks.

Anakin: Every e-commerce site wants to know exactly how every other e-commerce site is pricing the same goods, but it’s not always easy to do this systematically and comprehensively. Anakin fills this role, monitoring competing platforms for their clients and providing real-time pricing data so it can be undercut or otherwise responded to in order to snatch up that customer. With three “multibillion-dollar” companies paying half a million bucks a year already, Anakin seems well on its way to success. And maybe it’ll save you a few bucks as well.

TAG: Tag is building a neobank for Pakistan, a market that it claims features 100 million unbanked individuals out of a population of 250 million. The startup said that it is working with employers to help employees get their wages deposited into their TAG account instead of being handed out in cash. The company has local regulatory approval and is live in its market with a debit card product.

FirstIgnite: The team is building a marketplace that pairs companies with university experts to tackle challenges they’re facing. The team already has pilots with University of Chicago and Carnegie Mellon, among others.

Perfekto: Pitched as “Imperfect Foods for Latin America,” Perfekto delivers a subscription box of tasty-but-not-necessarily-pretty produce. Co-founder Anahí Sosa previously led the rollout of Uber Grocery in Latin America, and says Perfekto is currently seeing $8,000 in monthly revenue.

SFA Therapeutics: As digital health matures, SFA Therapeutics is the latest to pitch a new focus on treating the root cause of disease, instead of suppressing symptoms for momentary relief. The team is betting on an oral solution for the over 100 million patients who suffer from autoimmune diseases (and who currently deal with painful injections as a mainstream solution). The therapeutics company has a Phase 1B trial underway and referenced “strong clinical data” on their drug’s use in combating psoriasis.

Levo: Levo is supercharged savings accounts in Mexico, providing up to three times the average yield (6.5% vs. 2.1%) by combining customers’ accounts and negotiating better deals with the banks and other financial organizations they work with. It’s a smart idea in use around the world but apparently not for individual savings accounts in Mexico — for now!

Laudable: The B2B sales process needs to move past the PDF world, Laudable reckons. The startup wants to help its customers find and share videos of their customers using their product to share instead of written testimonials. We have some questions about how its product works, but the startup scaled from $0 to $27,000 in MRR in two months, so it appears to be onto something. Also sales tech tools have raised quite a lot of money in the last year, so there’s likely appetite for Laudable.

Monto: Monto’s team is building a platform that provides companies in Mexico with the ability to give workers “salary on demand,” which isn’t an advance but allows workers to request the salary they have already earned between paychecks. Workers are charged a flat rate of $34.50 + VAT.

Mindstate Design Labs: Mindstate says it’s working on “next-gen” psychedelic therapeutics for treating things like PTSD. One thing they’re working on is a “safer MDMA” that they say doesn’t cause post-treatment depression and would allow for a “greater ability to redose for increased efficacy.”

Beau: Small businesses have finally been peer pressured into digitizing their operations for more seamless customer experiences — it only took a pandemic. Beau is building a no-code client workflow for customer communications. With Beau, these businesses can collect submissions, files, payments and send messages to build loyalty (and do their jobs). The minimum viable product has been launched to seven paying customers and 65 active companies.

Ruth Health: Pregnant women receive a lot of care but once the baby is born, there are months of health issues they still have to deal with — and little support provided by existing medical providers. Ruth Health is a telehealth clinic focused specifically on postpartum care, with $150 out-of-pocket sessions to address common women’s issues like painful sex and unwanted urination. Their rallying cry is “for vagina owners, by vagina owners!”

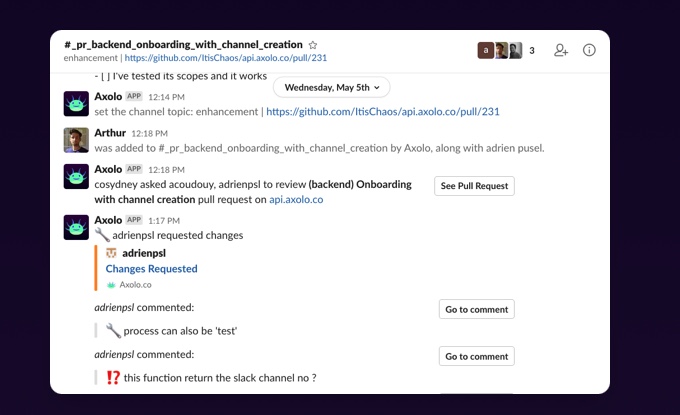

Image Credits: Axolo

Axolo: Offering what it calls a “war room for each pull request,” Axolo is a startup building in what we might call the developer productivity space. Its service creates a Slack channel around pull requests that helps engineers avoid swapping from Github back to their internal chats. The company says around 35 organizations are using its product today, and intends to monetize using a freemium model. Axolo will cost around $8 per engineer per month.

Ananya Health: The team at Ananya Health is building a portable medical device that can freeze abnormal cells much cheaper than existing solutions. The team is focused specifically on using the device to treat cervical “pre-cancer” in regions across the world where medical help is hardest to reach.

Noloco : A no-code tool for agencies/real estate firms/small businesses to easily build branded portals for interacting with clients, handling things like communication and file sharing. Co-founder Simon Curran says the company is currently seeing an MRR of $1,500.

Govly: Red tape has a way of bringing people together. Govly helps companies like Cisco and Nutanix come together to bid on government contracts. It wants to grow beyond a SaaS tool and into a marketplace that helps businesses sell into the government. The team hopes to be a better visualization into the business-to-government procurement space.

Walrus: Countless young people in India sign up for their first bank account every year. Walrus thinks it would be nice if they signed up with them — a neobank that offers a simple debit card and tools for saving, budgeting and investing. With a straightforward 1% transaction fee model it could be the simplest way for folks there to start banking.

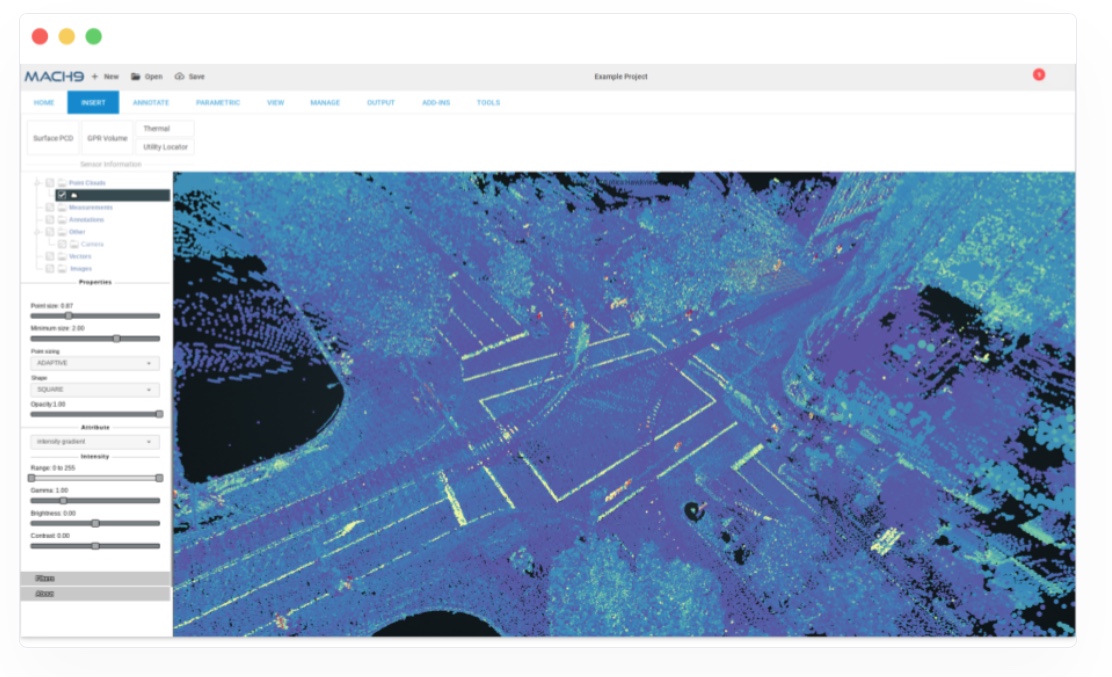

Image Credits: Mach9

Mach9 Robotics: Ah the modern world, full of wonder and aging infrastructure. Sure, we’ve built a lot, but a lot of our infrastructure is fraying. And that means inspections are a pretty big deal. But inspecting stuff in the ground is a huge pain in the backside. Mach9 uses a thermal camera attached to a car to peer into the Earth and find infrastructure issues. The company claims three paid pilots.

Algo University: Algo University is taking the ISA learning model to India, training university students there to become solid software engineers. Students also have the option to pay upfront for the education platform, which teams live classes, assignments and contests to help students pick up skills that hopefully land them at top tech jobs.

Therify: Therapy works better when you’re talking to someone that you feel understands you. Therify provides mental healthcare as a benefit to companies, focusing on matching patients with therapists who have similar backgrounds. Co-founder James Murray says it’s currently running $100,000 in paid pilots with “four global companies.”

Jovian: The “Great Resignation” has led companies to get quite nifty with their benefits, with one impact being the rise of investment in employee education. To take advantage of these shifting employer habits, Jovian has an ambitious goal: be the best technical university online. The job-oriented training platform helps professionals shape up on data science and ML skills. It has a monthly revenue of $20,000 and is growing 35% month over month.

Argonaut: Practically every tech company that wants to scale will need to deploy infrastructure to the cloud, causing words like Kubernetes, Terraform and containerization to be uttered. Argonaut automates this deployment as much as possible to reduce or eliminate the need for specialized engineering work, so even dummies like me can launch a company.

Abhi: Here’s another startup working on the Pakistani market. Abhi wants to offer instant wage access to workers in the country. Early traction appears to be good, with some $15,000 in total payment volume in its first month. The startup claims to have 45 MOUs — a very non-GAAP sort of contract, if you will — that represent around 200,000 employees. If it converts a few of those into real agreements, Abhi should have enough volume to truly test its model in the country.

Dots: Dots (one of two companies called Dots in this cohort!) is building a software product to help automate online customer communities, plugging into platforms like Slack and Discord and allowing companies to automate certain tasks and help them ensure new community members don’t slip through the cracks.

Stack: Pitched as “Vanguard for India,” Stack is trying to make investing easier for the 130 million middle-income households in the region. Launched six weeks ago, they’ve got 1,000+ users with $250,000 under management.

Epinoma: CRISPR transformed biology, and the world’s understanding of the human genome. Epinoma, led by three biogenetic experts, builds off those learnings to apply them to the world of epigenetics. The first application for its protein is for the liquid biopsy market, which the team estimates is a $50 billion opportunity.

Koshex: Obviously the middle class in India needs somewhere to put their money. If they don’t want to use Stack (two entries above) then maybe they’ll go for Koshex, which bills itself as “Wealthfront for India.” Integrated with more than 40 financial institutions already, Kosher is prepared to handle billions of dollars worth of Indian small investments.

Shimmer: Therapy is good and if everyone could access regular therapy it would be good for the world. But there aren’t enough therapists, and the service is often too expensive for folks in need — if they can get access. Shimmer wants to bridge the need-coverage gap by offering online mental health support groups that are run by coaches. Peer support can be pretty key to helping with various issues, as anyone in recovery can tell you. The company has 105 users today and claims 2x the retention of traditional therapy.

FrontPage: Building on the retail investor boom, FrontPage wants to build a Public.com for India, helping market investors and traders find a community of people interested in the finance world while browsing trades, charts and new discussions taking place in real time.

HyperGlue: Once you’ve got a big audience, keeping track of what your users are saying about you all around the internet gets tough. HyperGlue analyzes things that people share in places like Reddit and Discord to give product managers an automated breakdown of what people are saying about your product — the things they hate, the features they want, etc.

Oneistox: Online-cohort based classes for designers, architects and engineers — sold at roughly $900 bucks a pop. Oneistox wants to fill industry skill gaps through the virtual school, which mainly markets to those in their mid-20s and above. Early completion rates are 82%, dozens of percentage points above industry standards from massive open online course providers — signaling its format may just work.

Greenwork: With the huge infrastructure bill coming through, demand for skilled blue-collar labor will be jumping over the next few years. Greenwork wants to organize it with a LinkedIn-like site for these folks, often government-trained experts who need to find a project to apply their skills to. A recruitment and networking platform just for this valuable class of workers could be just the thing to get people back to work.

marketfeed: This is fun. Marketfeed is an app that trains users in India to trade stocks. Its founder claims to be akin to the Jim Cramer of India, with a boatload of YouTube subs to back up the claim. So far the app has reached around $100,000 in MRR. Seeing how popular trading has become in Europe and the United States in the last few quarters marketfeed’s general thrust makes sense.

Warrant: Warrant is building a platform that helps developers add authorization and access control to their web and mobile apps. The company’s API manages the complexity while users are able to define rules that meet the needs of their product.

SalaryBox: Not to be confused with “SalaryBook” from yesterday, SalaryBox is also aiming to be Gusto for India, helping the many millions of SMBs there to take their paper-based payroll (etc.) digital. The team says it’s seeing $18,000 in annual revenue just a few months after launch.

Evidence: Code! Code! Code! Evidence helps data teams replace drag-and-drop business intelligence tools with a code-based workflow, which a fancy way to say that it makes work more simple. The company is betting it can build the default front end for data management, as “every company becomes a data company.” Evidence of this? Evidence has 46 active projects after launching last week.

Female Invest: Investment is an industry dominated by men, but women command an increasing proportion of investable income. Female Invest aims to educate and mobilize this growing contingent and already has more than 17,000 paying subscribers in its community. Soon they’ll activate trading as well and fulfill their ambition of becoming the “Robinhood for women.”

Inversion Space: Instead of taking stuff to space, Inversion Space wants to bring some back from space. That’s an, ahem, inversion of what we tend to hear from space startups. The startup is building a return “capsule” that is four feet in diameter and wants to be able to drop stuff from space back to the planet in under an hour. Notably the startup claims some $225 million worth of LOIs, which may sound like a lot, but given what it costs to do anything in space, keep the number in scale. Inversion is targeting a first launch (drop?) in mid-2023.

Advantage Club: The team is building a wide-ranging platform for employee engagement, teaming perks, exclusive rewards and access to early wages. They’re hoping to bring multiple benefits into a single platform while catering to top customers with their deep web of more than 10,000 brand partners.

DigiBuild: Construction management software built on the blockchain to give a “verifiable single version of truth” to all owners/contractors/subcontractors/etc. Co-founder Rob Salvador says the company is currently seeing an MRR of $58,000, projecting that to grow to $75,000 by October.

Rivia.AI: D2C brands in India need better ways to get their products into ever-impatient consumer hands. Instead of forcing brands to rely on Amazon for two-day delivery speed, Rivia.AI is building its own fulfillment agency to help this customer base get the same outcome, but cheaper. By ignoring Amazon, Rivia.AI is helping e-commerce brands in India achieve two-day shipment, while the startup makes $0.65 on each delivery. Rivia.AI has 2,400 monthly transactions — and a mission to get to the billions.

Palla: Sending money across borders has never been easy. Or rather, if it’s easy, it’s expensive. Palla aims to make it both easy and cheap to send money to and from LatAm, from one person to another. They’re partnering with big fintech and banking companies to get thousands of folks signed up and ready to get cash from out of the country on their debit cards in seconds rather than hours.

Suplias: This is cool. There are 13 million small grocery stores in Africa, Suplias says, which it wants to help supply. The startup offers a B2B mobile marketplace that uses third-party logistics providers to get new inventory to small grocers rapidly. The digitization of SMBs in emerging markets is a well-known trend, but this is a bit different. And if the margins are good, it could scale pretty rapidly. Suplias claims $230,000 in GMV per month today, a figure that it says is growing by 40% each month.

Marble: Marble helps property owners manage their properties from afar. The platform handles rent collection and maintenance in addition to remote showings, collecting $50 per unit per month, significantly undercutting competitor pricing.

Zoios: Analytics for HR that the company says can predict who is going to quit, who is burned out, etc. Co-founder Christian Højbo Møller says they currently have 12 companies as customers paying for 500 seats and have hit an ARR of $24,000.

BoldVoice: Duolingo may be the best-known language learning app on the market, but BoldVoice has a deep focus in one area that unicorn is missing: smart speech. The startup wants to help non-native English speakers find (and flaunt) their voices. The startup uses short-form videos, taught by Hollywood accent coaches who traditionally help actors, to deliver content. The curriculum is built around three Ps: posture, to help with the physical feel of using an English R versus a Spanish R; phonology, the vowels and consonants; and porosity, which is the musicality of an accent. In two months, it has hit $5,000 in monthly revenue from over 200 paid uses. We wrote more about the startup on TechCrunch.

Sleek: Impulse buys on the internet aren’t actually any easier than big buys. You still have to go through the whole checkout process, except on the few shops that offer one-click fire-and-forget checkout. But what if I told you there was a startup offering a browser extension that makes every online shop have a one-click checkout … AND it gives you cash back? That’s the pitch with Sleek’s ML-powered checkout bot. By preventing cart rot they increase sales, collect the commissions and pass on the savings to you. Of course, you’re still out the cost of that impulse buy you would have left behind … but let’s not talk about that.

Cloudanix: Lots of companies now use more than one public cloud provider. So not just AWS, or just Azure, but GCP and others as well. Cloudanix wants to provide a unified dashboard to help companies keep all their public cloud work secure from a single dashboard. Per its website, the startup provides security monitoring and “remediation workflows” when needed. As the world becomes increasingly a multicloud domain, the company could find itself riding a secular shift.

FastFarma: A digital pharmacy that promises 30-minute medication delivery for Latin America, currently operating in Ecuador and Mexico. Co-founder Santiago Ribadeneira says the company is currently doing $20,000 in monthly revenue.

Image Credits: Stipop

Stipop: An easy-to-install SDK that developers can use to add stickers to their consumer chat apps. Already has 150,000 stickers designed by 5,000 artists and has been integrated into over 100 apps. Stipop monetizes through brand-sticker partnerships.

Siglo: Internet service providers are complicated to work with, which is always a green light for savvy entrepreneurs. Siglo is disrupting the ISP market for urban communities in Latin America. Focusing on easy-to-pay and simplified processes, Siglos’ wireless home broadband service currently connects over 1,700 homes with $26,000 in monthly recurring revenue. Its revenue is growing 30% monthly.

Telivy: SMBs need cyber insurance, and Telivy wants to give it to them. It’s as simple as that. They specialize in this and offer better and cheaper coverage so that SMBs can meet compliance and other requirements easier.

CartX: Shopify’s huge growth is drawing startup attention. CartX wants to build something akin to Shopify for the Brazilian market. As companies like Nubank have shown, the Brazilian digital market can prove lucrative. So to see CartX work on its e-commerce infrastructure is not a surprise. The company, now around two years old, is doing just under $1 million in yearly revenue today.

HomeBreeze: A home repair marketplace that is aiming to get rid of the annoying back-and-forth estimate process, instead providing up-front fixed/guaranteed prices and instant service scheduling. They’re focusing on water heaters first. Co-founder Vineet Mehta says the company is seeing over $60,000 in monthly revenue after launching in May.

Tuli Health: Tuli Health is building software that helps pharmacies in the U.K. perform in-house diagnostic tests. It started with COVID testing but is now expanding into allergy testing. Co-founder Jiawei Li says the company has onboarded 147 pharmacies that have run over 7,000 diagnostic tests so far, accounting for $400,000 in revenue.

Alchemy: Sure, Shopify made it easier for businesses to sell online, but how do those same businesses create a dynamic, differentiated experience for their customers? Alchemy is a visual development platform that enables brands to build unique e-commerce experiences, sans the code. It launched in late July and has so far landed 11 initial customers accounting for $2,800 in monthly recurring revenue.

Okani: In LatAm, millions of people without primary care physicians either find a specialist by other means or end up going to the hospital instead. Okani acts as a digital primary care provider living in WhatsApp, so patients can meet with a doctor and get tailored referrals rather than take on the time and expense of a hospital trip.

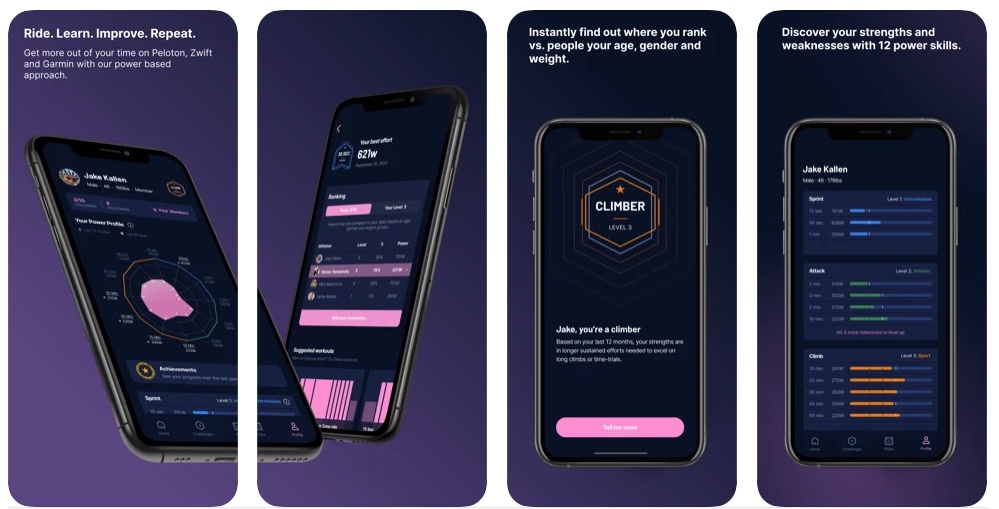

Image Credits: The Breakaway

The Breakaway: Ah, do you need more motivation to get back on your indoor bike? Is your Peloton sitting idle because you are worried that Matt will judge you for not doing enough Power Zone Max rides? The Breakaway is building a “motivational coaching” application for fitness dweebs like me. Its iOS app will link to your Peloton, so you can, well, cycle more? Better? I would joke that surely the $50 you already pay Peloton is enough, but since we’re already paying that, why not tack on more to perhaps cycle a bit more?

Hypercontext: This company says it helps managers run better meetings by streamlining their meetings according to their team’s OKRs and providing a dedicated place for agendas, feedback, follow-up steps, etc. The team says its MRR is currently at $37,000, charging teams $7 per user per month.

Fella: Telehealth for men with obesity. Combines recently FDA-approved medication with health coaching, charging $150 per user per month. The company has worked with 13 patients so far after launching in Texas two months ago.

Bedrock AI: Some of the best gems sit in the footnotes of corporate filings, from 10-K annual reports to Form D filings. Bedrock AI’s software extracts key factoids to limit information overload and better supplement those who spend their days working though the fine text of public company data.

Hiration: LinkedIn may have disrupted resumes, but Hiration wants to disrupt LinkedIn’s role in the job search process. The startup is building a way for job seekers to quickly create efficient resumes. Through partnerships with over 80 institutions, including Stanford and The University of Texas at Austin, Hiration created 125,000 resumes in August. It has an annual recurring revenue of $500,000.

CellChorus: All kinds of medicines, therapies, vaccines and other research processes need to understand what effects they create on a cell-by-cell level, but observing this directly can be very difficult. CellChorus does it, though, and has trained a machine learning model to watch footage of cell interactions and automatically derive conclusions like which cells perform best and why. They’ve already got traction and have been in multiple prestigious journals, so while it’s not something you’ll be using at home, it could be standard issue tech in medical research soon.

Secoda: Secoda wants to aggregate your company’s data in a single place, so that internal teams can better work together and share metadata, queries and more. Part of its pitch is that current tools in its domain are more targeted at enterprise-scale companies, while it wants to target smaller startups to start. That’s a standard GTM model for YC startups, but in this case it doesn’t bother us. The company claims $40,000 in ARR today.

Flowly: Pairs virtual reality headsets with a heartrate sensor to generate visualizations that the team is proving can reduce pain (and thus, opioid usage). They’ve got a $1.2 million grant from the NIH, and co-founder Celine Tien says the company is currently seeing over $40,000 in monthly revenue.

outloud.ai: Records and analyzes conversations in drive-thru restaurants to help owners figure out the best ways to upsell. Co-founder Sasha Miagkyi says they’re currently analyzing 700,000 orders per month at over 50 restaurants.

Baraka : An investment app built explicitly for the Middle East. Baraka launched one month ago and has attracted over $340,000 in assets under management with 70% week-over-week growth. Its mission is to give local retail investors the ability to put money into the U.S. stock markets.

Image Credits: Genomelink

Genomelink: Once you’ve had your DNA sequenced and analyzed by 23andMe or Ancestry, what else can you do with it? Upload it to Genomelink and you can activate any number of “apps,” — other forms of analysis that show more traits that the big companies don’t list. It’s your genomic data; you can do what you want with it, right?

PAYZE: Pitched as “Stripe for former Soviet Union countries,” PAYZE takes the fragmented payment solutions in the region and unifies them into a single payment platform. Co-founder Giorgi Tsurtsumia says they’re working with 350 merchants 8 months post-launch.

Revery AI: Revery is building a “virtual dressing room” that helps online shoppers visualize how clothing they’re shopping for will actually look like on a person, tapping AI to impose clothing images on models while allowing users to customize said model to look more like they do.

Plug: One API to process payments across multiple providers. Alex Vilhena says they take a 1% cut while saving teams up to 30% in processing fees and have processed over $230,000 to date.

Abbot: This former GitHub team saw firsthand the power of a streamlined, remote-first operating system, and now it’s building tools for other startups to do the same. Abbot makes the traditional team chats on Slack or Discord into a command center to get tasks done. It reacts to messages by running programs, deploying software or, heck, even displaying the weather.

Mecho Autotech: Believe it or not, the global logistics revolution is powered by drivers in actual vehicles, and those vehicles need maintenance, which cuts into earnings. Mecho Autotech is tackling the issue in Nigeria, where truckers sacrifice a lot of income to shoddy or inconvenient repairs. Instead, Mecho will let them summon one of the 2,000 mechanics on demand via a web app to fix things when and where they’re needed.

mello: After the absurd last few years, it’s no surprise we’re seeing an uptick in companies focusing on burnout. Mello reduces burnout by regularly checking in with employees, detecting shifts in happiness/productivity and offering up ways you might help them dig their way out. Currently ties into Slack, with plans for Teams/Discord/Google integrations on the roadmap.

Quest: An audio Q&A platform where experts can share advice and stories in short audio clips; think a micropodcasting Quora. The startup is focusing specifically on business advice early on and has over 10 hours of content from speakers at companies like YC and Google.

Concord Materials: Helps construction companies check invoices for accuracy and detect unauthorized charges. Founder Anthony Valente says they’ve got contracts in place to verify over $20 million of GMV.

Baubap: Baubap is a microfinancing platform for the traditionally underbanked in Mexico. The already-profitable mobile-lending app doles out capital to its users with a 90% return rate. Baubap’s mission isn’t small: It wants to become the largest lender in Latin America.

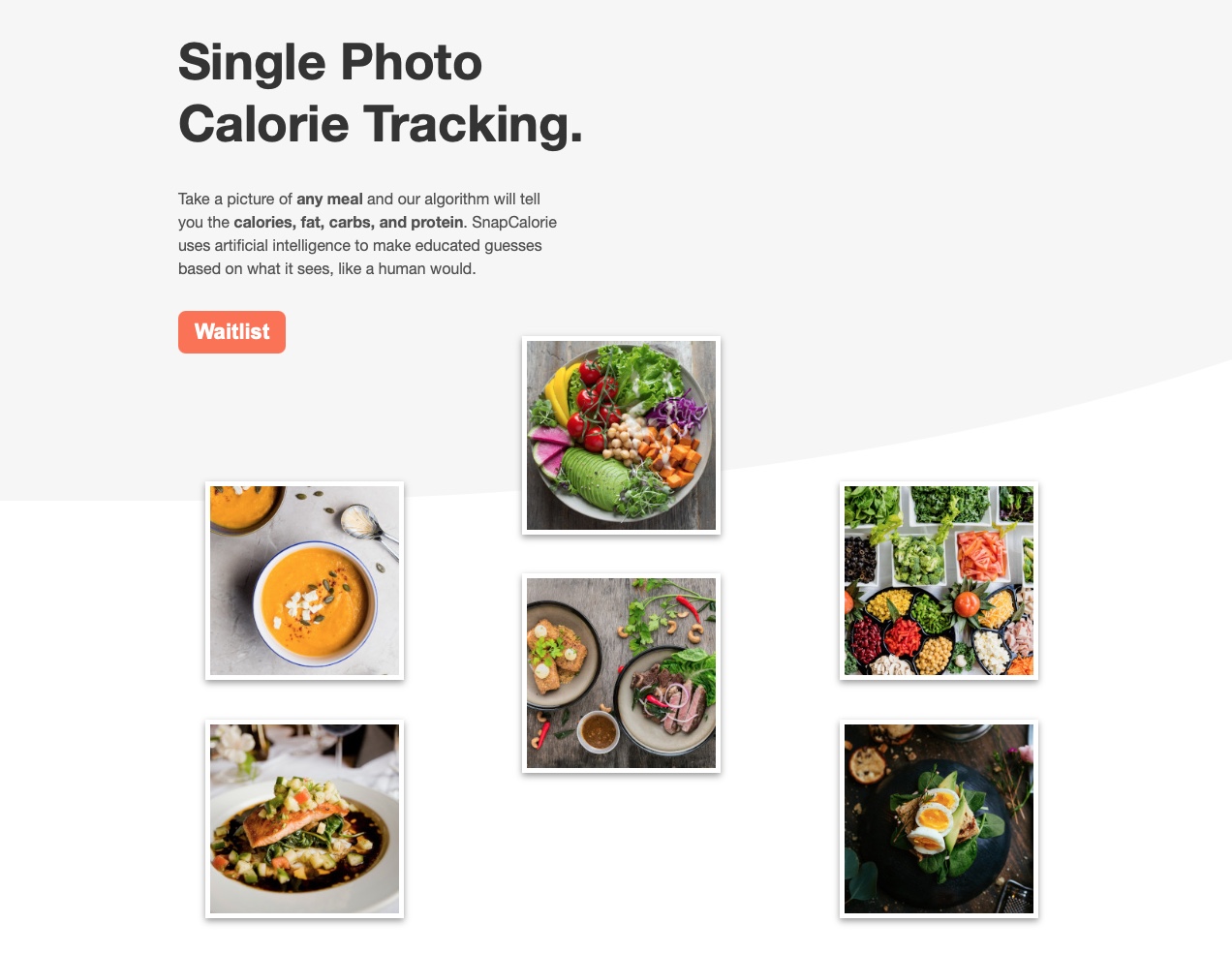

Image Credits: SnapCalorie

SnapCalorie: Nobody likes counting calories, because (A) calories are great and (B) it’s a pain. But SnapCalorie could at least address B by providing a calorie estimate of a meal from a single image that they claim is more accurate than a nutritionist’s. The founder also co-founded Google Lens and the Cloud Vision API so he knows of what he speaks. Don’t make it too convenient though buddy, because then I would have to use it.

Bree: Zero interest cash advances (up to $100) in Canada; instead of fees, Bree allows users to tip the service when it’s been helpful. Co-founder Alexander Li says the company did $14,000 in advances and saw $1,800 of revenue in July.

Zuma: Zuma is building out an “AI leasing agent” that helps make the most of web interest by responding and following up on every lead. In eight months, the team has grown to $388,000 ARR.

Medium Biosciences: Uses machine learning to find new/novel enzymes for biotech companies. The company says by cutting out much of the trial-and-error, it cuts a 10-week process down to two weeks.

Hyperseed: Already backed by Silicon Valley investors, Hyperseed makes it easier for finance professionals to create custom pricing and billing applications. The full-stack development environment helps finance teams add their thoughts into tech stacks, doing what the no-code team thinks Excel can’t.

Glitzi: An alternative to actually going to a salon or spa to get beauty or grooming services, Glitzi is an on-call service that connects beauty professionals directly to clients. The clients get the convenience of home care and the pros make more for the personalized service and no fees or rent for spa space. Everyone wins, and of course everyone is beautiful … that means you!

StandardCode: An API meant to help gaming/social companies deal with COPPA/GDPR compliance, automating the ID/parental approval/age verification process. Charges $0.50 per verification.

Payhippo: Payhippo is building a loan platform for small businesses in Nigeria, hoping to help bring access to working capital that can make a difference. They say that many of these businesses they lend to aren’t able to get loans from the bank due to high collateral requirements and the scarcity of credit scores in the region.

Image Credits: MayaEats

MayaEats: Pitching itself as “Uber for kitchens,” MayaEats works with “underutilized” kitchens to analyze their region/potential audience and build a virtual brand to sell on platforms like DoorDash and Uber Eats. Vijayaraj Gopinath says they’ve already processed over 57,000 orders, accounting for $2 million in GMV and a monthly recurring revenue of $30,000.

Contalink: Startups love to build SaaS for sales teams, but Contalink is refreshingly looking at another team for its software-based tool: the accounting department. The platform helps accountants move off of desktop software into the electronic cloud, a shift the team claims will make bookkeeping a much faster task. Starting with a focus on Mexico SMBs, Contalink has landed 2,700 paying users with $50,000 in monthly recurring revenue.

Numary: Moving large amounts of money around within or between organizations is something that needs to be done constantly and flawlessly. Numary wants to be the next standard financial ledger for money movements, starting with an open source base and taking aim at developers — the power behind the power.

Stepful : Helps those without college degrees train for and find entry-level healthcare jobs. Charging $3,000 per student, co-founder Carl Madi says the company has graduated 36 students to date.

Vinco: Vinco is a corporate benefits startup aiming to connect employees at Latin American companies with online education opportunities. The startup’s service is live at more than 30 companies, promising a way to improve employee retention and satisfaction.

Invezo: An investing research/analysis tool for stocks and crypto assets, tying social media data (read: hype!) and financial data together. Lets you, for example, track mentions of a cryptocurrency over Reddit/Twitter/Google/etc. Co-founder Emmett Miller says they’ve doubled weekly active users to over 5,000 in the last month.

Chipax: Describing itself as a “Quickbooks for SMBs in LatAm,” Chipax wants to give business owners real-time visibility on receivables and payables. The startup is expanding its revenue opportunities with invoicing and B2B payments. It has landed $1.6 million in annual recurring revenue across over 1,100 customers.

Catena Biosciences: Autoimmune disorders are devastating and difficult to treat. Catena has a new approach born out of work at CRISPR co-inventor Jennifer Doudna’s lab. By attaching custom proteins to red blood cells, they can retrain the immune system to cease its mistaken and destructive response, potentially providing a treatment for Graves’ disease, celiac disorder, multiple sclerosis and more. Big Pharma is already nosing around, as you might expect, and I predict a large valuation quite soon. (But more importantly, treatments for serious disorders.)

Kapacity.io: Connects to existing devices/products (like HVAC) in a building and controls them via API to reduce electricity costs, aiming for a 25% reduction and taking a cut of the savings.

Ancana: Ancana is a marketplace for fractional ownership of fully managed vacation homes, taking the idea of timeshares and Airbnb and creating a platform for shared homes where owners actually own a percentage of their property. Users collaborate with their co-owners to book time through the platform instead of relying on fixed timelines.

Keyri: A passwordless authentication API that taps your phone, QR codes and FaceID to sign you in to services without any passwords to type/share. Co-founder Zain Azeem says the company has four LOIs signed and is already working with 57 startups.

Fitia: The app creates personalized nutrition plans, using ingredients in local grocers, for LatAm users who want to lose weight. Users pay $55 per year, and the now-profitable startup attracts $70,000 in monthly revenue. Beyond trying to democratize the nutritionist, Fitia is also growing a database of over 1 million Latin American foods and recipes.

Evidently AI: Machine learning models are used almost universally in tech stacks, but telling when they’re failing and how isn’t as simple and established as something like “500 Error server not found.” Evidently wants to make tracking and debugging ML systems simpler and easier, so that faults can be identified and fixed faster. As authors of dozens of ML models themselves, the team thinks they’ve got the chops to do it. And who will naysay them?

Adaptyv Biosystems: A smaller, faster chip for biotech companies to synthesize and screen proteins. CEO Julian Englert says their chip is 100,000x smaller than existing options, allowing them to screen “millions of drugs instead of thousands.”; from the data they’ll gather, they’ll build “the world’s largest protein database.”

Awesomic: The team at Awesomic is building a design freelancing platform with a big emphasis on getting design jobs done quickly without the stress of hiring a designer.

Luable: Helps users in Latin America find saving accounts with better yields. Acting as a broker, Luable takes a 1.5% commission. The team says it currently has over $450,000 under management, averaging 2x growth month over month.

Image Credits: Craft Aerospace

Craft Aerospace: Craft Aerospace is designing and testing a totally novel new vertical take-off and landing aircraft designed to fly and land in and around cities, making regional travel faster and cheaper. The design of the aircraft is pretty wild, but it actually makes a lot of sense and could help change SF-to-LA into Tenderloin-to-Silverlake (well, maybe not that, but you get the idea). I wrote more about their new approach here.

Snowboard Software: If you know what the “Snowflake data cloud” is, Snowboard might be for you. Snowboard is a data catalog for Snowflake, allowing you to dig through your data on the platform faster, find data issues, etc. You can self-host it, or they’ll host for you; it’s free to start tinkering with, and you start paying after 1,000 indexed columns. The company says it’s currently seeing $15,000 ARR with four companies onboarded.

Jupe: First up, the Jupe founder who presented had an excellent hat. He was also living in a Jupe in a parking lot. Why? Because Jupe sells glamping-in-a-box. The company has booked some $6.5 million in revenue this year and claims to be profitable. It sells software and hardware and takes a pretty big cut of total spend. Er, is glamping a big industry? I have glamped. It was nice. Perhaps it is growing during the COVID era.

Hera: The team at Hera is building a Calendar app with an emphasis on productivity, with a number of overt and more subtle features aimed at helping people get the most out of their meetings without living in a bloated calendar app.

Astek.: Helps doctors find the right antibiotic faster — an hour, the company says, instead of days — in emergency situations. The company expects to charge $100 per test.

Protego: Founded by ex-Rappi entrepreneurs, Protego helps LatAm companies recover lost revenue. It automates the chargeback process, a process that currently requires quite a bit of manual labor. Since launch, it has attracted $4,300 in monthly recurring revenue and has turned its former employer into a pilot customer.

V-Flow Medical: Millions of Americans suffer from compressed pelvic veins, a dangerous condition usually treated with stents — which have a 20% failure rate. V-Flow has designed a device to treat the huge number of people who need an alternative treatment. With a track record of medical device approvals and exits behind them, the team says they have this whole thing mapped out and hopefully ready to keep hundreds of thousands of people healthy.

bloop: An extension for your code editor that surfaces code examples from each library’s official documentation. Works with VS Code, with support for other IDEs on the way.

Instacrops: An agtech startup focused on helping farmers in Latin America maximize their crop yields using technology like IoT sensors and drones while integrating data sources to help farmers make the best decisions with the best information available.

Bite Ninja: Bite Ninja wants drive-thru restaurants to use its freelancers (ninjas) to help others order and receive food (bites), allowing people to take drive-thru orders from home. One of the co-founders ran a BBQ restaurant chain called Baby Jacks, where he built out the initial concept. The team says it’s currently running pilots with five chains and would make $150,000 per restaurant location.

Pylon: One way to stand out in Y Combinator is to be a fully bootstrapped company making nearly double-digit revenue. That’s what Pylon, a platform to help water and electricity companies manage infrastructure, did in its pitch today. The profitable company improves its clients operations by detecting and reducing leakages, consumption theft and uncollected bills.

ClearMix: Organizing an in-person video team at a global company can be tough at the best of times, let alone during a pandemic. ClearMix is a fully remote video production suite that lets video teams record and produce videos quickly and professionally, but entirely online. No doubt it’s going up against some heavy hitters in the Adobe vein, but the need is clear.

Sequin : A fintech play, Sequin wants to give women debit cards to help them build credit — the card features what the company called “live credit reporting” — so that more women can access debt products. The company plans to eventually build a credit card product as well. Per Sequin, it expects to generate around $60 per user per year thanks to interchange incomes.

Teamspace: A remote collaboration platform built by a Facebook product designer who worked on the company’s Workplace product. The startup hopes to reduce team misalignment by giving them a “shared canvas” where they can tackle problems together.

Repool : Pitched as “AngelList for hedge funds,” Repool wants to let more people build hedge funds. “Focus on trading, we’ll take care of the rest,” they say. Co-founder Kevin Fu says the company has two funds onboarded after launching two weeks ago, already accounting for $36,000 in ARR.

SigmaOS: A browser designed for work. SigmaOS wants to be the main tool startups use to access the web, with an interface meant to promote multitasking and collaboration. Flagship features include split-screen capabilities, browser-based collaboration pages and focus mode. The productivity software startup charges $10 a month — and claims it’s gaining one customer every two minutes.

Whalesync: No-code tools are definitely popular (there have been plenty in the last two days) but they don’t solve every problem. And it turns out they create at least one new one — keeping data in sync between no-code tools can be tough and your devs end up having to code a data pipeline anyway. Whalesync connects no-code tools with each other, staving off the “real” coding for another step or two.

Yummy: Co-founded by a Postmates alum, Yummy is building a super app for Venezuela that it intends to expand to Peru and Chile. The company’s application includes food, CPG and entertainment products and claims to have expanded to ride-hailing as well. Yummy says that it is doing $1.6 million in monthly GMV, a figure that is growing by 35% each month. If that growth keeps up, expect to hear more about the company.

Level: A fintech financing platform that buys loans from fintech startups helping them gain access to capital to scale faster. The company analyzes the fintech company’s performance and loan portfolio to source low-risk loans it can purchase at a discounted rate.

Inflow: A self-help app for helping people manage ADHD. The company is promising symptom improvement on par with in-person treatment while making it “100x more affordable and accessible.” Co-founder Levi Epstein says Inflow has 2,700+ paying members and is currently seeing $33,000 in monthly recurring revenue.

Keeper: Bookkeepers often stick to spreadsheets and email, so Keeper has built a software solution with them in mind. The startup gives bookkeepers a suite of tools to communicate with clients and deliver reports. Focusing on the quiet but complicated has helped Keeper hit $6,400 in monthly recurring revenue.

Jingu Health: Millions of women suffer from vaginal infections with no effective treatment, but Jingu Health is coming to the rescue with a powerful tool. They target the underlying cause of these infections by analyzing the microbiome with computational biology tools and reprogramming it (think “more of this, less of this,” not bioengineered microorganisms). They claim to have the first pill-based treatment. It’s even FDA approved even though it doesn’t need to be … just in case.

Echoes HQ: This one could prove controversial. Echoes wants to measure engineering output and align time spent to different corporate OKRs. If TechCrunch rolled this out to measure writer output, there would be pitchforks in the streets.* Precisely how much engineers want to have their work monitored so that a manager elsewhere can chide them for whatever they deem to be “less than productive” is not clear. However, given how tight the market is for technical talent, if this introduces any sort of material friction, it would drive regretted employee churn, as they say.

*And by streets we mean various Slack channels.

Image Credits: Litnerd

Litnerd : Litnerd wants to help make kids better readers by keeping them more engaged in reading. They livestream actors into the classroom on a weekly basis to act out and advance stories the kids have spent the last few days reading, provide lesson plans for teachers and more. We wrote about Litnerd here!

DocVita: Telehealth has exploded during the pandemic. DocVita is looking to scale telehealth in India further with a platform that connects consumers with generalists and specialists across a wide network. The founders have experience in the healthcare software industry and have scaled the company to $12,000 in monthly GMV after just a few months on the market.

Waterplan: Tech and water may not usually mix well, unless you’re Waterplan. The startup helps industrial facilities mitigate water risk, a growing threat due to climate change and deterioration. It has $345,000 in annual recurring revenue thanks to 12 pilot customers.

Moxion Power: I (Alex) half expect this company to announce a SPAC-led deal to go public in the next month. It’s building large, mobile batteries that construction sites and other commercial operations can use to provide power in locations where they today use generators. Lower emissions is a win. The company expects to get its first production facility online in Q1 2022. Given the huge interest in EV tech more generally today, we like Moxion’s chances of raising the capital it needs to give its business a shot.

Lightly: A machine learning startup that helps ML teams prioritize the data most in need of labeling, pointing them to the data subsets that will have the biggest impact on their overall model accuracy.

Beeper: You probably use like a half dozen chat apps. Beeper merges them all together — even iMessage, through some hackery involving forwarding messages from a Mac or jailbroken iPhone — and adds things like unified search. Co-founders Eric Migicovsky and Brad Murray previously worked together at Pebble, the early smartwatch company Eric founded.

Rendalo Maq: A digital broker for construction equipment in LatAm. Clients turn to Rendalo Maq to procure and handle fleet management for construction companies in the region. While the startup’s software is focused on used equipment and rentals, it’s also a marketplace and operating system.

Basis: Look, if you’re in business automation like me, you understand that a dynamic end-to-end data pipeline is worth its weight in bitcoin. Was that convincing? Okay, I’m not in business automation but I can guess that with the amounts of data coming in and the number of places it needs to go, you want a big-time solution, and that’s what Basis wants to be. “Yes code” instead of no code, giving superpowers to your dev team so they don’t have to hire a specialist in data handling just to make things work.

Levro: Something that I’ve noticed among lots of smaller companies is building in many countries at once. That means that business itself is increasingly global. Which is great for remote workers, but a bit wonky when it comes to payments and banking. Levro appears to be prepping to help smooth the currency situation by offering a multicurrency banking service. The company dangled a hook during its pitch, offering free payments up to a transaction cap for folks tuned into Demo Day. Let’s see if that helps it drive early sign-ups. Its website currently only lets folks sign up for updates, so it may be some time until we fully grok Levro’s early traction.

Zazos: A no-code tool for HR teams that helps them build the exact functionality they need and leave out what they don’t while allowing customizations across interfaces, permissioning and data integrations.

Filadd: Helps students in Latin America pass their college entrance exams, then provides them with 24/7 access to tutors until they graduate. Co-founder Joaquin Olmedo says the company is currently seeing $800,000 in annual revenue.

testRigor: A better way to test for quality assurance. TestRigor has created technology that allows companies to run tests that better emulate the way end users engage with their applications. The software claims to be faster, non-engineer friendly, and thus more scalable for its clients. Netflix is one of the customers fueling testRigor’s $700,000 annual recurring revenue.

Heimdal: Heimdal pulls valuable minerals out of seawater while simultaneously sequestering carbon dioxide, producing carbon-negative materials for the concrete and glass industries. Cement manufacturing is notoriously a huge polluter, so with regulations coming in, they and everyone else are jonesing for green processes and raw materials. I wrote this up in more detail here!

Unbox: QA doesn’t get enough love in the ML world, but it matters. ML models can be biased as heck, or simply broken. Unbox wants to help ML team members, both technical and not, to find issues in ML models and create tests to check to make sure that fixes work. The team hails from Apple. Unbox did not share growth metrics.

Fizz: Fizz is building a debit card that helps college students in the U.S. start building out their credit without having to learn lessons about overzealous credit use the hard way. Building good credit early is critical but can be tough for college students operating on tight budgets, Fizz is building a platform designed for college students specifically.

Mentorcam: A marketplace connecting people with those they admire for advice — sorta like Cameo for 1:1 advice. Charging $20-$300 per video, they saw $7,000 in gross sales in August. Notably, the company says, nearly half of its users are repeat customers.

Telmai: Data quality can make or break a startup, so Telmai wants to be the reliable sidekick that sniffs out inaccuracies or anomalies before you do. The data observability platform uses a no-code onboarding process and claims it can begin working for clients within minutes. Beyond fighting bad data, Telmai offers high-level visualization, and soon, proactive alerts and user inputs for correctness. For data analytics teams, which are constantly deciding whether to escalate a blip, Telmai is meant to take some of the guesswork out of their days and more broadly simplify operations.

Amenli: Amenli is the first licensed online insurance broker in Egypt. Able to sign customers up in a few minutes for low-cost premiums around $200 per year, it’s hard to see how this can be anything but a runaway success assuming they do it right. Go get it, Amenli!

Nash: This is fun. Nash has built software atop mass-market delivery APIs (it listed DoorDash and Uber, among others) to allow other companies to offer same-day delivery. Why is it neat? Because SMBs can’t code, having another company plug them into delivery networks could unlock the delivery market for companies that can’t afford an engineering team. Per Nash, it has a 10% take rate and is doing around $60,000 in GMV.

Byte Kitchen: Byte Kitchen wants to build ghost kitchens that make the best dishes from the best restaurants in the country, licensing brands and recipes and bringing them access to more markets. Its first kitchen is live, and the team says its has “20+ LOIs with popular restaurants.”

Tenyks: Helps AI developers figure out how/why their computer vision systems are doing what they’re doing and build more reliable systems. With both co-founders having Ph.D.s in “Explainable AI,” this one seems like a good fit. Founder Botty Dimanov says they’re currently working with one customer, with four more getting set up now and seven+ on the waitlist.

Maroo: “Save the date” doesn’t exactly scream stable revenue, so Maroo is building a payments service for the wedding industry. The startup is rethinking how the business owners within the wedding industry — from caterers to that charming venue you eye every time you drive past it — receive payments. As for the happy couple, Maroo offers a buy now, pay later service for a more accessible financing option,

Tavus: Here’s one that might make you squint a little. Tavus wants to replace written outreach (think sales emails and such) with computer-generated deepfakes. Yes, you read that correctly. Customize the name, company and other aspects and get hundreds of tailored videos that look just like someone recorded a video message just for the recipient. Is it a good idea? We’ll see … but like it or not it’s here, and it seems to be effective. Let you and I proceed into this strange new world together, my friend.

Enso: The team at Enso is building a data processing tool that helps automate developer processes that require a ton of repetitive manual work. The no-code platform wants to put components built by its community of experts into the hands of data scientists.

Brite: When your employer offers you a zillion different benefits/insurance options, Brite helps you wade through it and figure out what’s right. Co-founder Ben Hale says they’ve already worked with over 400,000 employees (across 250+ employers) and are seeing an MRR of $28,000.

Metlo: The truth wins, and that’s a lesson for life and for startups. Metlo, built by former Facebook and Uber engineers, helps companies store their business metrics (like “daily active users”) in a standardized, transparent way across different tools without a bunch of duplicated work. In seven weeks, the startup landed four design partners.

MergeQueue: When you’ve got 20 engineers all coding separately to build a new feature, it can take as long to integrate and reconcile their work as it does to do it in the first place. MergeQueue automates code submission workflows to avoid build failures that result in costly code reviews and delays. The team encountered this issue at Google (easy to imagine) and hacked together their own solution there — now they’ve built something for everyone else to use.

CostCertified: Bringing price transparency to an opaque market is never too bad an idea. CostCertified wants to make the worlds of construction materials and labor more transparent with a marketplace and “real-time quoting engine” that it has built. Per the startup, it has around $250,000 in ARR from SaaS revenues today and intends to take a 1% cut of GMV in the future.

"all day" - Google News

September 02, 2021 at 06:02AM

https://ift.tt/3gR0BT6

Here are all the companies from Day 2 of Y Combinator’s Summer 2021 Demo Day - TechCrunch

"all day" - Google News

https://ift.tt/35pEz2D

Bagikan Berita Ini

0 Response to "Here are all the companies from Day 2 of Y Combinator’s Summer 2021 Demo Day - TechCrunch"

Post a Comment